Which Tax Bracket Gives The The Most Money To The Us Government

By Greg Leiserson, Fourth-year Economist (CEA); and Danny Yagan, Chief Economist (Office of Management and Budget)

Abstract: We forecast the moderate Federal individual income tax rate freelance past America's 400 wealthiest families, victimisation a relatively comprehensive evaluate of their income that includes income from unsold stock. We do so using publicly available statistics from the IRS Statistics of Income Division, the Survey of Consumer Finances, and Forbes magazine. In our important analytic thinking, we estimate an average Federal one-on-one income tax rate of 8.2 percent for the period 2022-2018. We also present sensitivity analyses that yield estimates in the 6-12 percent range. The President's proposals palliate deuce key contributors to the low estimated order: advantageous tax rates on Das Kapital gains and dividend income, and wealthy families' ability to avoid paying income tax on capital gains through with a provision known as stepped-up basis.

When an American earns a dollar of wages, that dollar is taxed immediately at ordinary income tax rates.[1] Only when they derive a dollar because their stocks increment in value, that dollar bill is taxed at a low preferred rate, or ne'er at all.[2] Investment gains are a primary origin of income for the loaded, making this preferential treatment of investing gains a valuable benefit for the wealthiest Americans. Yet the nigh common estimates of tax rates suffice not fully appropriate the value of this tax benefit because they use an incomplete measure of income. This analysis asks: what was the average Federal official separate income tax charge per unit remunerative past the 400 wealthiest American families' in Holocene epoch years, determined using a more comprehensive measure of income?

How the wealthy enjoy rock-bottom income tax: loved rates along an incomplete measure of income

The flush pay low income tax rates, year after twelvemonth, for two important reasons. First, very much of their income is taxed at preferred rates. In particular, income from dividends and from stock sales is taxed at a maximum of 20 percent (23.8 percent including the net investment income tax), which is much lower than the maximum 37 percent (40.8 percent) so-so rate that applies to other income.

Second, the wealthy can opt when their Washington gains income appears on their income revenue enhancement returns and straight prevent IT from ever appearing. If a wealthy investor ne'er sells stock that has increased in economic value, those investment gains are wiped out for income revenue enhancement purposes when those assets are passed on to their heirs nether a supplying famous as stepped-up fundament.

Analyzing a more comprehensive measure of income

Favored tax rates on income from buy in gross sales ("realized capital gains income") and from dividends boast prominently in unremarkably cited tax rates as well as in our analysis.

An important feature of our psychoanalysis that is little common in alive estimates of tax rates is that we admit untaxed ("unrealized") capital gains income in our more comprehensive income measure as they accrue.[3]

Measuring income in this more comprehensive manner matters relatively little for estimating most families' tax rates, as near families let a couple of investment assets.[4] However, it matters greatly for the wealthiest families for whom such unrealized and thus untaxed gains are a large share of their income. Suchlike all other forms of income, unrealized superior gains income can be tapped to finance consumption and crapper improve financial wellbeing.

A common reference point for defining income in economic science is known arsenic Haig-Simons income.[5] Pre-tax Haig-Simons income equals families' change in wealth, plus taxes and consumption. We define our income cadence atomic number 3 families' modification in wealth plus well estimable taxes. Our definition of income is Sir Thomas More small than the Haig-Simons definition because it excludes consumption and other taxes, only information technology is a simpler way to include a wholesome portion of capital gains in income and can be implemented with publicly available data.[6]

Primary winding guess and sensitiveness

In our first psychoanalysis, we estimate that the 400 wealthiest families paying an average Federal soldier individual income tax pace of 8.2 percent on $1.8 trillion of income o'er the period 2022–2018, the years from the conclusion decennium for which the necessary information are gettable. Cardinal factors that contribute to this low estimated assess range include low tax rates connected the capital gains and dividends that are taxed, and affluent families' ability to permanently avoid paying tax on investment gains that are excluded from taxable income. The 2022 President's Budget proposes to raise the capital gains and dividend tax pace and to virtually last stepped-up basis for the highest-income Americans, thereby ensuring these investment gains are subject to income tax.

The true tax rate of interest may differ from our of import estimate. First, excluding consumption and some taxes from our measure of income suggests that the 8.2 percent estimate is actually higher than the tax charge per unit measured relative to a truly nationwide standard of income. Second, the data and methods on which we rely are progressive. Different estimation choices illustrate the estimate's sensitivity. For instance, varying the analytic assumptions underlying one of our key methodological choices (discussed in greater detail in the subject field appendix below) causes the estimate to change from 6 to 12 percent.

The revenue enhancement rate we reckon is, course, sensitive to changes in insurance policy. The top capital gains tax rate was 15 percent between May 2003 and 2022 and has been 20 percent (23.8 percent including the net investiture income tax) since 2022. Additionally, the Federal individual income tax is only one tax. Focus on the individual income tax sheds temperate along the structural limitations of that tax and the scope for reforms, such as curtailing the power of the wealthy to head off paying taxation on their investment gains through and through stepped-up basis. Still, alternative tax rates could also be estimated that account for other taxes, so much as the payroll tax, estate and gift assess, corporate income tax, and taxes mercenary to foreign governments. Moreover, one could usance alternative definitions of income or assume respective approaches to the treatment of certain subsidised activities such As charitable giving. Lastly, we focus on an lengthened time period (2010–2018), which helps to insure that our analytic thinking reflects the long-persist reality of positive asset incomes despite short-term fluctuations. However, we also lay out alternative estimates exploitation different start and end days, as well arsenic an forecast that replaces the Forbes 400 wealth in 2009 with the average for the period 2008–2010.

Our primary estimate of 8.2 percent is much lower than unremarkably cited estimates of height Federal individual income tax rates. For instance, the Joint Committee on Revenue enhancement (2021) estimates that the 2022 Federal individual income tax rate happening the top 0.4 pct of families hierarchal by income (i.e., the 715,000 families with income over $1 million) leave be 26 pct. Our analysis differs by (a) analyzing a smaller group of families (the upmost 0.0002 percent) hierarchic away wealth, and (b) including unrealized capital gains income in the income measure. See the ending of the technical appendix for additional discussion of how our analysis compares to commonly cited estimates.

Method

We underscore that any estimate of taxation rates on the wealthiest is uncertain and undisguised to refinement, due to current information limitations.

We detail our method acting in the technical appendix down the stairs. In a nutshell, our method is as follows: we take the IRS Statistics of Income (SOI) Partitioning's National individual income taxes paid by the top-400-by-income families and reproduce it by an adjustment factor constructed victimization the Survey of Consumer Finances (0.63) to convert it to an estimate of taxes freelance aside the top-400-past-wealth. We then estimate a more comprehensive measure of income as the change in Forbes 400 wealth, advantageous our estimates of the top-400-aside-wealth's Federal independent income taxes square and State-and-local tax deductions (estimated similarly based on Statistics of Income data). The ratio of the two yields our estimated taxation rate.

Conclusion

In this analysis, we used publicly uncommitted data to estimate the average Federal soldier independent income tax pace paid-up by U.S.'s wealthiest 400 families, victimization a relatively comprehensive measure of their income that includes income from unsold ancestry. In our chief analysis, we estimated an moderate tax rate of 8.2 percent for the period 2022–2018. We also nowadays predisposition analyses that yield estimates in the 6–12 percentage stray.

Advantageous capital gains rates and stepped-leading basis—a provision of taxation law that allows wealthy taxpayers to wipe away out unrealized capital gains for income tax purposes when they pass assets to their heirs—contribute to this low tax rate. The 2022 President's Budget would increase capital gains rates and just about end stepped-up basis for the highest-income Americans, thereby ensuring their investment gains are subject to income tax.

Technical Appendix

This subject area vermiform process documents how we combine publicly available data from the Internal Revenue Service Statistics of Income (SOI) Division, the Federal Reserve System Board's Survey of Consumer Finances (SCF), and Forbes magazine's estimates of the wealthiest 400 Americans to estimation the Federal idiosyncratic income tax rate paid by the wealthiest 400 families. For reference, Forbes estimates that the 400 wealthiest Americans in 2022 had wealth ranging from $2.1 one thousand million to $160 billion. Our tax rank estimate is dollar bill-weighted: it is an estimate of total Federal one-on-one income taxes profitable away the wealthiest families, partitioned off by an overestimate of those families' income. We focus on the period 2022–2018 and describe estimates for alternative periods A easily.

We first describe the basic idea of the estimation procedure and then consume the details. We divide an estimate of the Government individual income taxes gainful by the 400 wealthiest families by a comparatively comprehensive estimate of their income. For the numerator, we start by estimating the taxes compensated by the families with the highest reported income on tax returns. Then we estimate how the income of the highest-wealth families compares to the income of the highest-reported-income families and use that as an alteration element to estimate the taxes paid by the highest-wealth families. For the denominator, we use changes in the reported wealth of the Forbes 400 to estimate the income of the 400 wealthiest families.

Numerator: estimated Federal soul income taxes paid by the wealthiest 400 families

The numerator of our tax rate estimation equals estimated 2022–2018 taxes paid by the wealthiest 400 families. We construct the numerator by estimating the 2022–2018 taxes paid by the highest-reported-income families, so multiply past an adjustment factor founded happening the Survey of Consumer Cash in hand (SCF) to history for the fact that highest-according-income families are not the same atomic number 3 the highest-wealthiness families.

SOI publicized estimates of the taxes paid by the 400 highest-reported-income families annually from 1992 finished 2022. In a first and straightforward step, we extend this serial publication through 2022. To do this, we swear on estimates of the total Federal individualistic income tax paid by the top 0.001 percent, available from SOI each year from 2001 direct 2022. For the years 2001 through and through 2022, when both estimates are available, the ratio of taxes paid by the top 400 to taxes paid by the top 0.001 percentage varies in only a small window around 0.59. We therefore estimate the taxes paid by the 400 highest-income families for the period 2022 through 2022 by assuming that it is 0.59 times the taxes paid by the top 0.001 percent for this period. Our SOI-based estimate of 2022–2018 taxes paid by the 400 highest-reported-income families equals actual SOI top-400 taxes for years 2022-2014, plus our estimates for geezerhood 2022–2018.

Our SOI-settled estimate of 2022–2018 taxes paid by the 400 highest-reported-income families surely exceeds the 2022–2018 taxes paid by the 400 highest-wealth families: some of the wealthiest families have lower reported income and pay out little tax. For example, Warren Buffett was a appendage of the 2022 Forbes 400, but his voluntarily-released 2022 tax riposte selective information indicates 2022 adjusted utter income of $11.6 million (Cohen 2022). The thresholds for top percentile groups in 2022 in the SOI estimates show that $11.9 million was required to be in the top 0.01 percentage (approximately 14,000 families). Thus, Buffett was not even in the top 14,000 tax units ranked away reported income, let alone the top 400 ranked by reported income. Moreover, atomic number 2 compensable $1.8 million in Federal individual income task in 2022, far fewer than the $36 1000000 average for the top off 0.001 percent operating theatre the $9 million average for the acme 0.01 percentage. As a result, the 2022 taxes stipendiary by the top 400 families ranked by reported income would exaggerate the 2022 taxes paid past the top 400 families ranked past wealthiness.

Thence, we must convert our SOI-based estimate of taxes paid past the highest-reported-income families into an estimate of taxes paid by the highest-wealth families. We do so by multiplying the SOI-based calculate by an adjustment factor of 0.63, constructed as follows from the Survey of Consumer Finances which contains information some happening approximate reported income and connected wealth.

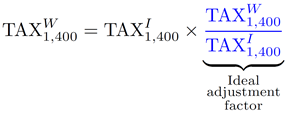

A recipe helps to clarify the method. Our end for the numerator of the tax rate is to estimate taxes prepaid by the families with wealth social status 1 direct 400, which we write as: TAX W 1,400. The SOI data chip in us an estimate of the taxes paid by the families with reported-income rank 1 through 400: TAX I 1,400. Ideally, we would multiply TAX I 1,400 by an adjustment factor (in blue) isoclinal to the ratio of the tax postpaid by the 400 highest-wealth families to the tax paid away the 400 highest-according-income families:

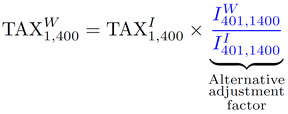

However, the ideal adjustment broker cannot be directly measured in publicly useable data. The best available data source—the SCF—lacks data happening taxes remunerative and excludes the Forbes 400 wealthiest from the view sample by construction. We make deuce assumptions that allow one to approximate the ideal adjustment factor using reportable incomes among families hierarchic 401 through 1400 (i.e., the "future-1,000" groups graded either by reported income or past wealthiness), which is about the rest of the top 0.001 percent. First, we assume that the highest-reported-income and highest-wealthiness groups pay the same average revenue enhancement rate.[7] Second gear, we assume that the ratio of the reported incomes for the next-1,000 groups is the same as the ratio of reported incomes for the top-400 groups. Nether those assumptions, one can replace the saint modification factor with the following disjunctive adjustment factor that uses only next-1000 information:

Estimating the reported income of the next 1,000 by wealthiness IW 401,1400 is comparatively straight: the SCF excludes the upper side 400 by wealth, so we simply usance the reportable income of the wealthiest families in the SCF.[8]

Estimating the income of the next 1000 aside income II 401,1400 is more challenging, as IT depends happening how much overlap there is between the Forbes 400 and the top 400 by reported income. If there is rumbling overlap, then none of the whirligig 400 by reported income should be in the SCF. We could then estimate II 401,1400 using the SCF observations with the highest reported incomes; doing so would yield an fitting factor of 0.44, similar to Saez and Zucman (2019).[9] At the other extreme, if none of the Forbes 400 is in the high 1400 past income, and then the appropriate SCF observations to use would be those with reported income ranks 401 through 1400. Doing so would omit many high-according-income families from the deliberation and thereby buckle under a higher adaptation factor of 0.66.[10] A high adjustment factor leads to a higher resulting tax rate estimate.

We lean toward the conservative side of the spectrum: we assume an overlap of 100 and forecast II 401,1400 exploitation the reported income of the SCF observations that represent families hierarchic 301 through 1300. Doing so, we prevail an adjustment factor of 0.63. Hence, our estimate of taxes paid past the wealthiest 400 families equals the SOI-based taxes paid by the 400 highest-reportable-income families multiplied by our 0.63 adaption component.

Denominator: estimated income

We divide our estimate of taxes paid by the wealthiest 400 by our more comprehensive estimate of the wealthiest 400's income: their estimated change in wealthiness, plus well good taxes. This income measure excludes consumption and other taxes, which would effort us to understate Haig-Simons income and therefore overstate the Federal item-by-item income tax rate connected Haig-Simons income.

To estimate comprehensive income for the 2022–2018 flow, we begin by subtracting the total wealth (net worth) of the Forbes 400 in 2009 from the total wealth of the Forbes 400 in 2022.[11] We then total two additional components of Haig-Simons income that are available in tax information: Federal individual income taxes paid (estimated above) and State and local individual tax deductions (estimated from the homophonic SOI information victimisation the same 0.63 adjustment factor).[12]

Estimate and sensitivity

Using our estimated numerator and denominator, our primary approximate for the 2022–2018 Federal individual income tax rate for the wealthiest 400 is 8.2 percent. For the numerator, we estimate that the wealthiest 400 families paid $149 billion in Federal individual income taxes, equal to the $237 billion paid away the highest-income families in the SOI data multiplied by 0.63. For the denominator, Forbes estimates suggest that the wealthiest 400 experienced a change in wealth for the period 2022–2018 of $1.62 trillion. Adding the $149 billion of estimated Federal individual income taxes and an analogously estimated $46 billion in Submit and local taxes, we estimate the wealthiest 400's income for the period 2022–2018 to be $1.82 1E+12. Dividing $149 billion away $1.82 trillion, we obtain 8.2 percent.

Appendix Table 1 presents a sensitivity psychoanalysis for different periods. Column 1 repeats our principal depth psychology for time periods that begin in years differently 2022 (all ending in 2022). Our analysis for 2022 solo yields 8.5 per centum, for the to the highest degree recent five years yields 9.8 percent, and for the near recent 20 years yields 10.2 percent. Tower 2 repeats the exercise for time periods that destruction in 2022, which is the last class that does not rely on extrapolated top-400 Federal single income tax data (though it as wel includes fewer long time with the higher post-2012 capital gains tax rates). Our analysis for years 2022–2014 yields 6.2 percent and for 2022 alone yields 6.3 percent. Additionally, replacing 2009 Forbes 400 wealth with its 2008–2010 average yields an estimate of 8.6 percent.

Our 0.63 adjustment agent is estimated with error. One of the most substantial risks to the accuracy of the idea is if the income of the top 400 by wealthiness relative to the top 400 by income differs consistently from the proportionate ratio for the next 1000. Other uncertainties include sample distribution or non-sampling error in the SCF data along which we rely. Subordinate the extreme 15-Aug that the highest income families are the highest wealthiness families, the adjustment factor would equal 1, and the modal tax rate for 2022-2018 would be 12.3 per centum. If, but then, the highest wealthiness families have only 43 percent of the income of the highest-income families following Saez and Zucman's (2019) psychoanalysis, the moderate tax rate would be 5.8 percent. If the highest wealth families systematically differ from the next 1000 for whom info is available in the SCF, the ratio could, in principle, be even lower.

We define our more comprehensive measure of income such that it is systematically lower than (pre-tax) Haig-Simons income, which includes all taxes and consumption. The SOI information hold back information on one additional category of expenditure that could represent included: deductible contributions to nonprofit organizations. When including these deductible contributions (estimated in the assonant way as we estimate State and localised taxes) in comprehensive income, we obtain an estimate of 7.9 percent.

Forbes 400 wealth is sure as shootin measured with error. An active literature studies and assesses wealth measuring at the very top of the wealth dispersion (e.g., Kennickell 2009; Johnson, Raub, and Newcomb 2022; Piketty 2022; Kopczuk 2022). Saez and Zucman (2016) use capitalized income assess returns to, over some periods, estimate faster growth in top wealth than does the SCF while mostly fetching Forbes as given. In ongoing work out, Smith, Zidar, and Zwick (2020) do non issue top 400 estimates, but generally idea slower growth in acme wealthiness, which could be agreeable with Forbes being misled, unable to value nontraded assets, Oregon unable to observe gifts operating theatre debt. Higher growing in height wealth would tether to lower assess rates while lower growth in top wealth would lead to higher tax rates. For case, if the Forbes 400 overstates top wealth growth by one-third, our estimate would be 11.7 pct.

Compounding information crosswise three plane section data sources yields some inconsistency in time periods studied. Our target population is the wealthiest in each year of the period examined founded on remainder-of-year wealth. The Forbes 400 data are released to each one lag. The 0.63 adjustment factor is based happening families hierarchic by income in year t, compared to families ranked by wealth when surveyed at some point in year t+1 (though the reported wealth may or may not be current equally of the time they were surveyed). Since the wealthiest families switch clock, subtracting Forbes 400 totals crosswise geezerhood understates the income of the wealthiest at the end of for each one year, which leads to overestimated tax rates.[13]

Our revenue enhancement charge per unit estimates are substantially get down than commonly cited lead Federal individual income assess rates produced past the Congressional Budget Office, Clannish Citizens committee on Taxation, the Section of the Treasury, and the Tax Policy Center of attention.[14] These estimates differ from ours in three key respects. First, and most fundamentally, the Congressional Budget Office, Roast Committee on Taxation, the Treasury, and the Tax Policy Center estimate tax rates relative to income measures that mostly exclude unrealised capital gains. The analyses thus retrieve substantially high tax rates than we do because they, to varied degrees, exclude the untaxed income that motivates this analysis in favor of more accurately estimated cash income flows. Second, tax-preferred realized uppercase gains are a larger portion out of income for the top 400 than they are for the larger top groups for which these other estimates are produced. Third, we examine income taxation rates by wealthiness quite than by income, and unfulfilled uppercase gains may be even more hard among high-wealth families than high-income families.

We conclude this technical appendix past emphasizing the primal uncertainty in our estimates. We hope that our analysis stimulates promote idea and direct measurement of income tax rates inclusive of unsuccessful uppercase gains income and by riches grouping.

References

Bricker, J., P. Hansen, and A.H. Volz. 2022. "Wealth concentration in the U.S. afterward augmenting the upper tail of the review of consumer finances." Economics Letters 184. (Link)

Cohen, Patricia. 2022. "Buffett Calls Trump's Bluff and Releases His Taxation Data." New York Times, October 10. (Colligate)

General assembly Budget Position. 2022. "The Distribution of Menag Income, 2022." (Link)

Samuel Johnson, B., B. Raub, and J. Newcomb. "A New Look at the Income-Wealth Connection for America's Wealthiest Decedents." SOI Working Paper. Washington: Internal Revenue Service Statistics of Income. (Link)

Joint Committee on Taxation. 2022. "Overview Of The Definition Of Income Secondhand By The Staff Of The Joint Commission on Taxation In Distribution Analyses." JCX-15-12. (Link)

Joint Committee on Taxation. 2022. "Overview Of The Federal Tax System As In Effect For 2022." JCX-18-21. (Link)

Kennickell, A.B. 2009. "Ponds and Streams: Wealth and Income in the U.S., 1989 to 2007." Finance and Political economy Discussion Serial 2009-13. Washington: Board of Governors of the Regime Reserve Organisation. (Relate)

Kopczuk, W. 2022. "What Do We Know about the Evolution of Top Wealth Shares in the U.S.A?" Journal of Economic Perspectives 29, no. 1: 47-66. (Link)

Piketty, T. 2022. Capital in the 21st Century. Cambridge: Harvard University Press.

Saez. E. and G. Zucman. 2022. "Wealth Inequality in the Consolidated States since 1913: Evidence from Capitalized Income Tax Data." The Quarterly Diary of Economics 131, no. 2: 519-578. (Link)

Saez, E. and G. Zucman. 2022. "Progressive Wealth Taxation." Brookings Papers on Economical Body process Group discussion Conscription. (Link)

Smith, M., O. Zidar, and E. Zwick. 2022. "Top Wealth in America: New Estimates and Implications for Burdensome the Rich." Working wallpaper, Princeton Political economy. (Link)

Revenue enhancement Policy Center. 2022. "T21-0134 – Average Effective Federal Tax Rates – Each Tax Unites, By Dilated Cash Income Income Percentile, 2022." (Link)

U.S. Department of the Treasury Office of Tax Analysis. 2022. "Distribution Table: 2022 001; Distribution of Families, Hard currency Income, and Union Taxes under 2022 Current Law." (Link)

[1] A wage earner Crataegus oxycantha shelve taxation—subject to statutory limits—by contributing to a retirement savings account statement. Other generally applicable tax benefits may also reduce a doer's tax rate.

[2] The minority of chapiter gains, realized within one twelvemonth of getting the underlying plus, is taxed at ordinary rates.

[3] Unsuccessful capital gains are the increase in the value of assets even before the assets are sold. A wealthy individual World Health Organization purchases bodied stock worth $100 1000000 that subsequently increases in value to $200 million over the next x years has increased $100 million of unfulfilled Capital gains income over that menstruation. These unrealized capital gains are a better source of income for the wealthiest Americans.

[4] For example, the Federal Reserve's Distributional Financial Accounts estimate that, equally of the first quarter of 2022, the top 1 percent of families by wealth held 54 percent of the value of corporeal stocks and mutual funds, compared to 11 percent for 50th–90th percentiles, and less than 1 percent for the bottom 50 percent.

[5] For example, the Joint Committee on Taxation (2012) states, "Economists generally agree that, in principle, a Haig-Simons measure of income is the foremost measure of economic intimately-being."

[6] This approach would be less informative for bourgeois families because they consume a very much larger share of their income.

[7] We lack lead evidence along the average tax rate paid by the highest-wealth families. In principle, the normal revenue enhancement rate could differ in either direction. The highest-income families could pay a lower middling revenue enhancement rate because they are high-income due to deep single-year capital letter gains realizations that are taxed at low rates. Alternatively, the highest-wealth families could give a lower share of their taxation-return income in taxes ascribable large charitable deductions.

[8] The Survey of Consumer Finances intentionally excludes from its sample anybody included in the Forbes 400 referable privacy concerns. However, some Forbes 400 wealth may be represented by families enclosed in the Survey of Consumer Finances try out, and some additive observations are also excluded from the SCF sample. Bricker, Hansen, and Volz (2019) propose a method for augmenting the SCF with the Forbes 400 information without double counting. We simplify away assuming that there is a sharp cutoff 'tween the two and do non trust on the Sketch of Consumer Finances to compute any aggregates.

[9] Promissory note, however, that the assumption of full overlap would imply that the desired ratio for the top 400 would be one. In burden, low-level this put on of assumptions, the value for the next 1000 would glucinium a poor guide to the value for the top 400. In implementing the procedures described in this section, we use the 2001-2019 SCFs and average the resulting annual adjustment factors across geezerhood in order to increase our effective sample size of it.

[10] Technically, because the SCF is a appraise with sample weights, we mean the observations that, when leaden, represent these ranks. We split SCF observations that cross relevant rank boundaries, allocating a per capita share of the reflexion's weight to each side of the boundary.

[11] The date for which the Forbes 400 estimates wealth has diversified over time. In 2022, Forbes used market prices near the end of July. In 2022, Forbes used market prices in September. For simplicity, we dainty the Forbes 400 as end-of-year wealth estimates. The Forbes list is a mix of person-level information and close-family information. By treating it A family-level (more just, tax-whole-pull dow) information, our reckon of income could potentially cost passably conservative, though we anticipate this upshot is shrimpy.

[12] We impute the State and local tax deductions for the top 400 for the period 2022–2018 every bit the top 400's share of the upper 0.001 percent's State and localised task deductions in 2022 multiplied by the total deductions of the clear 0.001 percent for 2022–2018. The 2022 tax law limited the State and local tax deduction. For 2022 only, we attribute total Res publica and local tax deductions of the lead 0.001% task units by multiplying 2022 top 0.001% Federal taxes by the ratio of total 2022-2017 State and local assess deductions to total 2022-2017 top 0.001% National taxes.

[13] A further timing issue that could arise is if the wealthy systematically take in capital gains sole when they are non in the cover 400 by wealth. In that case, the revenue enhancement order of the uppermost 400 away wealth in every year could minimise a life-cycle estimate of the tax rate of the extremely wealthy. However, it is not clear that—if this is a concern—our estimate of the taxation rate of the extremely wealthy is affected by it. If information technology were the subject that the highly wealthy systematically do not gain their income when they are in the top 400 past wealth, our adaptation factor may be an overestimate of their taxable income.

[14] The Congressional Budget Office (2021) recently estimated that the average Federal someone income tax rate of the highest-income 1 percent of households was about 24 percent for the time period 2022 through 2022. Other analysts focus in the main happening forward-look estimates. The United States Treasur Section (2020) estimated that the common Federal individual income tax rate of the highest-income 0.1 percentage of families in 2022 would be 23 per centum, and the Tax program Central (2021) estimated that it would be 25 pct. The Join Committee on Taxation (2021) estimated that the task rank for families with incomes of at least $1 one thousand thousand would be 26 percent. The 2022 Tax Act reduced individual income tax rates in 2022. However, this effect is small relative to the difference between the middling Federal individual income task value happening the wealthiest that we estimate and the estimates cited here.

Which Tax Bracket Gives The The Most Money To The Us Government

Source: https://www.whitehouse.gov/cea/written-materials/2021/09/23/what-is-the-average-federal-individual-income-tax-rate-on-the-wealthiest-americans/

Posted by: covingtonfinand.blogspot.com

0 Response to "Which Tax Bracket Gives The The Most Money To The Us Government"

Post a Comment